Credit facilities are more flexible than traditional loans wherein the borrower can take out finance over an extended period. Similar to outcome-linked loans, blue-linked credit facilities are also linked to sustainability performance targets and key performance indicators.

Definition and Key Features

Best for Public or Private beneficiary: Private

Ideal size of beneficiary: SME and Large corporates/entities

A loan facility is a financial product that enables borrowers to access funds to fulfil their financial needs. It allows borrowers to take out money over an extended period of time rather than reapplying for a loan each time that capital is needed. It is basically “an agreement between a lender and a borrower that allows for greater flexibility than traditional loans.” The facility can be utilized for various purposes, including financing a new project, initiating a business, or consolidating debts. The proceeds of the Sustainability-linked Credit Facility can be used to fund all of the Mission Ocean objectives.

The borrower's credit history and financial situation, as well as the nature and characteristics of the project determine whether the loan facility is secured or unsecured. Secured loans require the borrower to provide a collateral, such as property, licenses, etc. Unsecured loans, on the other hand, do not require any collateral, but for this reason they usually carry higher interest rates in comparison to secured loans.

Through this type of facility, borrowers have a relatively wide flexibility to choose the loan amount, repayment term, and interest rate that align with their specific objectives. The loan application process tends to be straightforward, and borrowers can expect timely funds disbursement upon approval of their application.

Types of issuers and investors

Issuers/Beneficiaries: This instrument is most commonly issued by private sector actors such as corporates or financial institutions

Investors: Mainly private investors (e.g. venture capital firms and investments banks)

Strength and criticisms

A loan facility provides several advantages to borrowers, including:

- Use for Mission Ocean’s Objectives: the facility can be used to finance projects and activities related to each of the 3 Mission Ocean’s objectives: the protection and restoration of marine and freshwater ecosystems, the elimination of marine pollution, and development of a carbon neutral and circular blue economy.

- Flexibility: Borrowers can choose the loan amount, repayment term, and interest rate that best suit their needs. This flexibility allows borrowers to manage their finances in the most suitable way for their specific short- and long-term needs.

- Easy application process: The loan application process is relatively simple and can be usually completed both online or in-person, making the whole procedure quick and convenient for the borrowers.

- Quick access to funds: Once the loan application is approved, borrowers can receive the funds in a timely manner, without getting caught in bureaucratic delays or additional administrative procedures.

- Credit score improvement: Once the loan is secured, making regular, on-time repayments can help borrowers to improve their company’s credit score, supporting them to qualify for better loan terms in the future (if needed).

While the loan facility offers some advantages, there are also some potential disadvantages to consider, such as:

- High interest rates: Unsecured loans often have higher interest rates than secured loans. This can make borrowing more expensive for some debtors.

- Risk of default: If borrowers fail to make their loan payments, they may default on the loan. This can result in additional fees and damage to the borrowers’ credit score.

- Additional fees: Some loans may come with additional fees, such as origination fees or prepayment penalties. These additional expenses will be added on top of the overall cost of borrowing.

Case Studies

Case Study: Cargotec’s sustainability-linked revolving credit facility

Ocean Mission Objectives reached: 3

On December 2022, Cargotec Corporation managed to secure a sustainability-driven credit facility worth EUR 330 million. The facility was established in collaboration with a group of 7 trusted banks and it has a duration span of five years with the option to extend it for 2 additional years. Cargotec's objective in securing this facility is to refinance the standing credit facility (EUR 300 million), which is set to mature in 2024. The important new feature in comparison to the previous facility consists in the introduction of the Cargotec's long-term sustainability objectives into the loans’ framework. At the core of this facility lies a crucial sustainability key performance indicator: the Cargotec's commitment to combat climate change by aiming to achieve a 50% reduction in CO2 emissions across its ports, sea, and roads value chain by 2030.

Process of Issuance

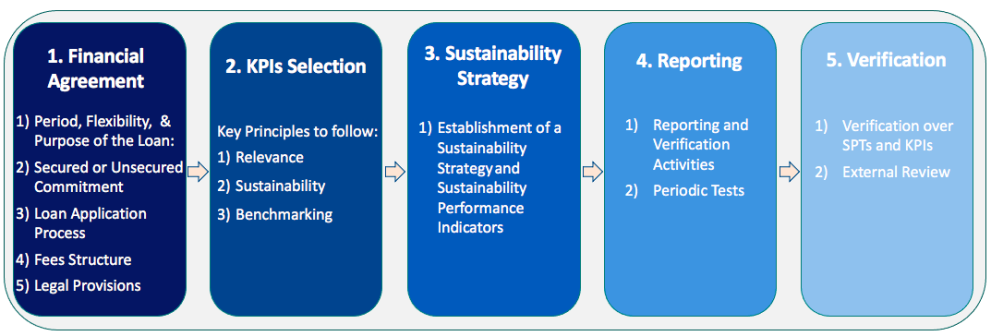

Key Practical Steps to Structure a Sustainability-linked Credit Facility

Source: Author 2023