Definition and Key Features

Best for Public or Private beneficiary: Both

Ideal size of beneficiary: SME and Large corporates/entities

A sustainability-linked loan refers to a financial instrument that connects the features of the loan with the sustainability performance of the borrower. The distinctive characteristic of such loans is the utilization of Key Performance Indicators (KPIs) to gauge the borrower's sustainability performance. The KPIs are typically aligned with Environmental, Social, and Governance (ESG) aspects such as greenhouse gas emissions, water conservation, or employee inclusivity. The proceeds of the Outcome- linked Loan can be used to fund all of the Mission Ocean objectives. The loan's terms are customized based on whether the borrower meets or surpasses these KPIs. For example, if the borrower satisfies the KPIs, the loan's interest rate may be reduced (coupon step-down). Alternatively, if the borrower falls short of the KPIs, the interest rate may be increased (coupon step-up).

Sustainability-linked loans can be availed by various entities, including non-profits, governments, and corporations. They can be structured as bilateral loans between the borrower and lender or as syndicated loans that involve multiple lenders.

Types of issuers and investors

Issuers/Beneficiaries: Most commonly corporates and financial institutions, though possible to be issued by public actors

Investors: Private investors (e.g. venture capital firms and investments banks) and non-private financial players (e.g. development banks, sovereign wealth funds)

Strength and criticisms

There are several advantages to sustainability-linked loans, such as:

- Use for Mission Ocean’s Objectives: the loan can be used to finance projects and activities related to each of the 3 Mission Ocean’s objectives: the protection and restoration of marine and freshwater ecosystems, the elimination of marine pollution, and development of a carbon neutral and circular blue economy.

- Inclusion of financial incentives: this instrument provides borrowers with a financial incentive to improve their sustainability performance. By linking the terms of the loan to sustainability KPIs, borrowers are motivated to take actions that will improve their ESG performance, helping to drive positive change in the business or organization.

- Flexibility: This type of loan offer flexibility to borrowers because the KPIs can be customized and tailored on the basis of specific borrowers’ sustainability goals, making sure that the loan is aligned with the borrower's overall sustainability strategy and goals.

- Proof of Commitment: These loans can be seen as a way for borrowers to demonstrate their commitment into the sustainability space to investors and other relevant stakeholders. By taking out a sustainability-linked loan, borrowers are signalling their commitment to improve the company’s sustainability performance and become accountable for its progress on this path.

While there are some important advantages in using sustainability-linked loans, there are also some potential drawbacks to consider, including:

- Costs and Complexity: an important and potential shortcoming of these instruments is that they may be more complex and costly to structure than traditional loans. Mainly because the use of KPIs and performance targets require extensive due diligence and monitoring effort in comparison to vanilla loans.

- KPIs Insufficient Penalties: another potential drawback of sustainability-linked loans is that the penalties for failing to meet the KPIs may be relatively limited, especially in the case of corporate bonds. Low penalties are market standard, and their increase may reduce the attraction over this instrument as it will make it riskier for the beneficiary. An example can be found in the case study below where the penalty for not achieving the KPIs was just 10bps.

- Limited Scalability: while these instruments can be used by a wide range of borrowers, they may not be scalable for all types of projects or activities. The KPIs selected are usually unique for a specific project and depend highly on setting smart and measurable targets. This makes more difficult to standardize and scale this financial product as different KPIs will need to be developed for different projects and this process, as explained in the sections above, is very time and resource consuming.

Case Studies

The Standard Chartered’s Sustainability-linked Loan to CSSC

Ocean Mission Objectives reached: 3

One of the most interesting cases of sustainability linked loan in the blue space is the 10-year, USD 96 million sustainability-linked loan provided by Standard Chartered to CSSC (Hong Kong) Shipping Company Limited. This loan was specifically designed to support CSSC's decarbonisation efforts in line with China’s 2060 pledge and the development of the company’s sustainability strategic goals. Such instrument marks a significant milestone for both Standard Chartered and CSSC Leasing as it represents their debut in sustainable finance within the shipping industry in Greater China and North Asia.

The transaction exhibits notable distinctions from conventional ship financing. To begin with, the loan adheres to the Sustainability Linked Loan Principles that aim to promote sustainable economic growth with a focus on environmental and social factors. Furthermore, during the whole loan tenure, an assessment of the four ships' average efficiency ratio and other sustainable measures will be conducted regularly.

Process of Issuance

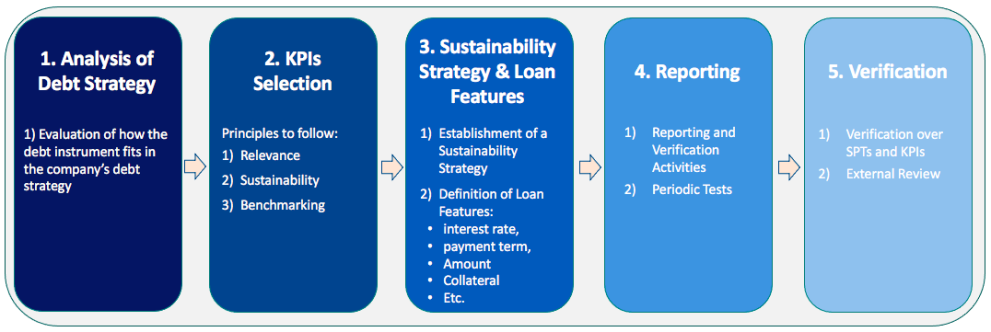

Key Practical Steps to Issue an Outcome-linked Loan

Source: Author