A Blue Bond is a debt instrument that national governments, development banks and corporations issue to raise finance for marine and ocean-based projects that have long-term sustainability objectives and benefits. Blue Bonds work like conventional bonds wherein an investor lends capital to the bond issuer who pays back the initial investment plus an interest rate every year until the end of the bond’s term.

Definition and Key Features

Best for Public or Private beneficiary: Both

Ideal size of beneficiary: Large corporate/entities

Blue bond is a recently introduced use-of-proceeds bond, which is a debt instrument that national governments, development banks, and corporates issue to raise funds for financing marine and ocean-based projects that have positive economic, and environmental benefits26. The blue bond works as a conventional bond: investors lend capital to the beneficiary who pays back the initial investment (principal) and interest rate (coupon) every year until the end of the bond's term. The capital collected is directed towards activities that meet the criteria of a blue project, defined as sustainable activities in the ocean or marine-related area. The proceeds of the Blue bond can be used to fund all of the Mission Ocean objectives. More broadly, blue bonds are designed to support the realization of the Sustainable Development Goals 6 and 14, as well as initiatives related to SDGs 2, 7, 12, 13, and 15. In order to qualify as a blue project, a project is usually expected be consistent with the project categories of Green Bond Principles and Green Loan Principles and contribute to either Sustainable Development Goal 6 or 14 with outputs and outcomes directly related to one or more of the target indicators of Sustainable Development Goals.

Bonds can be categorized by the type of beneficiary. They can be generally differentiated between private bonds (corporate and project-specific) or public bonds (sovereign and municipal).

Private blue bonds are primarily created to support the acquisition, expansion, or to restructure of blue-oriented initiatives such as new wind factories. These bonds are usually repaid by the beneficiary exclusively through the proceeds from the activity without any reliance on other potential revenue streams. They can be listed on stock exchanges or operated on an unlisted basis. Long-term liability investors such as pension funds and insurers are attracted to this type of instrument due to their long maturity and fixed rate nature. Such features make blue bonds more suitable for large-scale infrastructure projects related to maritime transportation or marine renewable energy28. However Blue Bonds can also be issued to raise funds for more general use, and as long as it is related to the blue environment (as defined in the SDG) it can be called a Blue Bond.

The mechanism at the basis of sovereign bonds is similar to corporate or project bonds, with the key difference being that the beneficiary is a sovereign or municipal entity. As a result, the risk appetite is typically lower in comparison to the private bonds, resulting in a lower yield coupon.

Types of issuers and investors

Issuers/Beneficiaries: A Blue Bond can be issued by sovereigns, financial institutions, MDBs, corporates and municipalities

Investors: Private investors (e.g. angel investors, high net worth individuals, family offices, venture capital firms, investments banks) and non-private financial players (e.g. development banks, sovereign wealth funds and foundations)

Strength and criticisms

In comparison to other similar instruments, blue bonds have several advantages, which include:

- Use for Mission Ocean’s Objectives: blue bonds can be used to finance projects and activities related to each of the 3 Mission Ocean’s objectives: the protection and restoration of marine and freshwater ecosystems, the elimination of marine pollution, and development of a carbon neutral and circular blue economy.

- Investment Promotion: Blue bonds serve as an innovative bridge to attract private investments, especially from capital markets, into marine health-related projects. For instance, considering the vast potential of blue resources, blue bonds can offer Small Island Developing States (SIDS) significant opportunities to develop a thriving economy. Such ecosystems rely entirely on long-term oceanic health, and blue bonds can finance strategically designed portfolios of projects to bring in additional capital, more effective project implementation practices, and a meaningful impact on the overall region's blue economy. All activities that have been particularly challenging so far for this sector.

- Broad Sustainability Improvement: Blue bonds are designed to directly raise capital for projects that have a direct impact on ocean and marine-related issues while, at the same time, advancing other sustainability factors, such as social inclusion, economic growth, environmental protection, and the broader Sustainable Development Goals (SDGs). This means that a blue bond’s investment goes beyond the only marine conservation and restoration, deeply affecting several other dimensions of the economic and environmental area where the use of proceeds is deployed.

- Partnerships Development: The use of the private sector’s funding can be supported by public institutions in several ways (technical assistance, use of de-risking capital etc. – more in the chapter 5), securing an efficient public-private partnership that could bring several benefits for the involved private actors and for the country’s blue economy sector. These bonds can also contribute to raising awareness of the critical role of ocean and marine resources among both public and private actors.

However, blue bonds also face some key criticisms, such as:

- Price: Thematic bonds are not necessarily cheaper in comparison to more classic bonds. In fact, bond prices are not determined by a specific usage of the proceeds in comparison to another. To define the price, the key influential element to consider is the credit rating of the instrument, as investors prioritize them to determine the interest rate to charge, and this may vary on the basis of different factors (credibility of the project and the beneficiary, market where the blue initiative is carried out, etc.).

- Fungibility and Impact Demonstration: When it comes to this type of instruments, there is a high risk that the raised capital may be deployed for other purposes from blue-focused activities. To avoid such practice, a comprehensive measurement, reporting and verification (MRV) system needs to be put in place by the beneficiary. However, such practice is complex, time-consuming, and resource-intensive, and not always efficient and well planned. On top of that, even if the capital is well allocated, demonstrating the desired impact of bond proceeds can be very difficult.

- Earmarking: Linking bonds to specific expenditures decreases the level of flexibility that the beneficiary has in allocating the raised capital. This can lead to a situation where the company/sovereign can experience an overfunding or underfunding of its initiatives. Additionally, promises to bond buyers and fiscal austerity can have unintended trade-off consequences, resulting in reductions of investments in other critical development areas.

Case Studies

World Bank Blue Bond against Plastic Pollution in the Oceans

Ocean Mission Objectives reached: 1& 2

The World Bank (WB) unveiled a Blue Development Bond aimed at spotlighting the urgent issue of marine plastic pollution. This bond represents an ongoing endeavour by the WB to engage with investors in emphasizing the significance of preserving freshwater and marine resources. Designed as a callable stepped-up fixed rate bond, it targeted both individual and institutional investors, successfully pricing on June 15, 2022, and raising the substantial amount of USD15,000,000. The exclusive distributor for this bond was J.P. Morgan Securities LLC. This WB bond adheres to the comprehensive sustainability bond guidelines introduced by the International Capital Markets Association (ICMA) and it focuses on supporting the SDG 14 (Life Below Water) and SDG 6 (Clean Water & Sanitation). More in detail, potential supported projects could range from large regional fisheries programmes to water and marine pollution reduction from improving water sanitation to the support of sustainable coastal development.

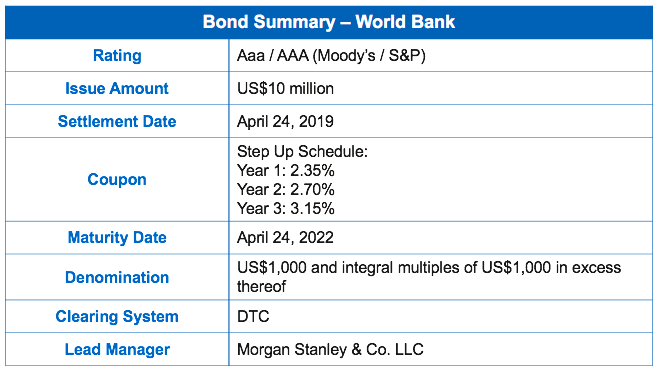

World Bank Blue Bond – Features Summary

Source: World Bank, 2019

Process of Issuance

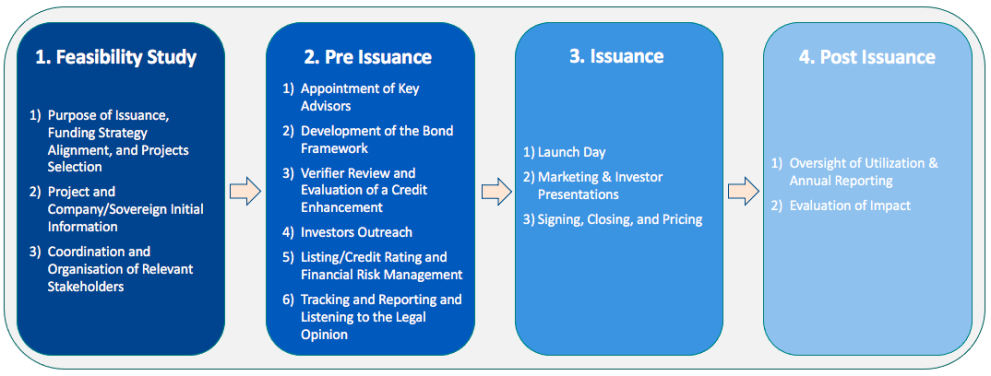

Key Practical Steps to issue a Blue Bond

Source: World Bank, 2019