This refers to the process of integrating different types of capital from diverse sources into a single financial instrument for the blue economy to minimise risks and maximise scale. Borrowers for this type of financing includes small to medium-sized businesses in the blue economy (e.g. fisheries), while Foundations and NGOs and larger (public) financial institutions (e.g. European Investment Bank) tend to be the sponsors and investors, respectively.

Definition and Key Features

Best for Public or Private beneficiary: Both

Ideal size of beneficiary: SME and Large corporates/entities

Blended finance refers to the process of integrating in a single financial instrument different types of capital from diverse sources to minimize risks and maximize scale. As defined by the Organization for Economic Co-operation and Development (OECD), the primary objective of blended finance is “to strategically utilize development capital to mobilize additional finance for sustainable development”. The supplementary finance is of a commercial nature and may not be explicitly designated for development purposes, while development finance incorporates both public and private finance that are deployed with a specific development mandate.

Blended finance constitutes an effective instrument to unlock capital for projects that are considered too precarious for a single capital provider. Public-private partnerships are commonly employed to blend capital, with a public entity (for instance a development or municipal bank) collaborating with private funds and corporations. Such partnership allows each player to develop useful projects whilst generating returns. The proceeds of a Blended Finance Fund can be used to fund all of the Mission Ocean objectives.

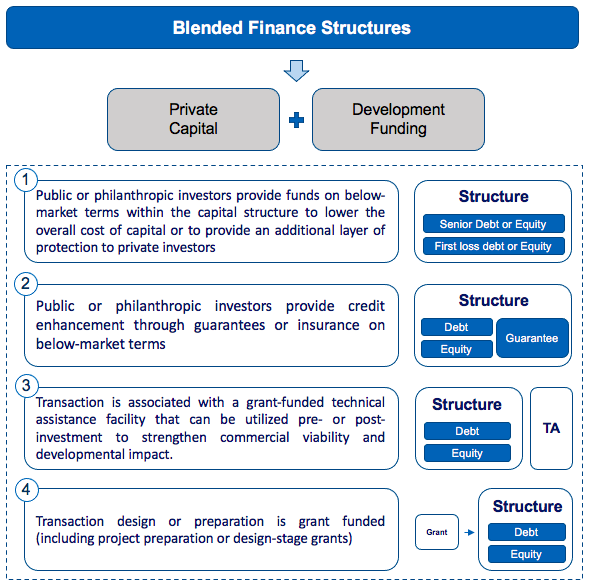

The essential components of a capital stack in a blended finance structure can incorporate guarantees, impact mezzanine investment, commercial equity and debt. The seniority of capital determines the sequence in which investors receive payment in the event of an investment pay-out: senior investors are paid first, and junior investors are paid last. In the case of bankruptcy, the risk is absorbed by public capital, guarantee, and first-loss facilities, making them invaluable tools in blended finance practices, as they can be structured to absorb a percentage of the investment principal's loss and protect the rest of the capital stack. Mezzanine capital can also play an important role in reducing the cost of capital by bridging the risk/return gap between equity and debt.

Types of issuers and investors

Issuers/Beneficiaries: Can be issued by sovereigns, financial institutions, MDBs, corporates and municipalities

Investors: Private investors (e.g. venture capital firms and investments banks) and non-private financial players (e.g. development banks, sovereign wealth funds)

Strength and criticisms

Blended finance funds offer several advantages to both investors and communities that benefit from the development of sustainable projects:

- Use for Mission Ocean’s Objectives: the fund can be used to finance projects and provide technical support activities related to each of the 3 Mission Ocean’s objectives: the protection and restoration of marine and freshwater ecosystems, the elimination of marine pollution, and development of a carbon neutral and circular blue economy. The Mission Ocean Objective that is reached depends on the project that is funded by the financial instrument.

- Increase of Investors’ opportunities: for investors, blended finance funds can offer a more attractive risk-return profile than traditional private equity or venture capital investments, providing the opportunity to invest in sustainable projects that align with their values while also earning a financial return. The increased interest from investors will broaden the investor base for the beneficiary when funding its Ocean Mission Objective- based project.

- Increase of projects’ success rate: blended finance funds can help de-risking investments by providing financing for technical assistance, capacity building, and risk management. This can help to ensure the success of the development projects and improve the overall financial performance of the fund. In particular, for emerging asset classes, such as Nature-based Solutions (NBS), blended finance instruments can be particularly effective in scaling the projects and providing guarantees that support private investors’ intervention

- Investments catalysation for communities: blended finance funds can help catalysing investment in critical infrastructure and social services, bridging the financing gap between public and private sector investors and ensuring that development projects receive the necessary funding to succeed, even if their risk profile is higher is comparison to more traditional investments.

On the other side, this type of instrument faces a series of important challenges that need to be taken into account:

- Complexity: one of the main issues of blended finance is the complexity of the product structuring process where different stakeholders and cashflows need to be combined into one single product.

- Definition of the Balance Between Returns and Impact: another challenge is finding the right balance between the financial returns that investors require and the social and environmental impact that the development projects aim to achieve. Some investors may prioritize financial returns over impact, while others may be willing to accept lower returns in exchange for greater social and environmental benefits.

- Measurement of Social and Environmental impact: another challenge consists in measuring the social and environmental impact of the projects. Unlike traditional investments, where financial returns can be easily quantified, measuring impact requires a more nuanced approach in blended finance. This can make it difficult to assess the success of the funds and determine whether they are achieving their sustainability goals.

- Legal and Regulatory Requirements: Another issue is the need to navigate the legal and regulatory finance requirements of different jurisdictions. Blended finance funds often involve investors and projects located in multiple countries, each with its own legal and regulatory framework. The fund manager must be able to navigate these different requirements and ensure compliance with all relevant regulations.

- Extensive Marketing Practices: Fund managers may need to engage in extensive marketing and outreach efforts to attract a diverse profile of investors and, consequently, of capital. This may be a very time-consuming and difficult activity, given the high risks perceived by investors in some projects.

Case Studies

Case Study: The Althelia’s Sustainable Marine Fund

Ocean Mission Objectives reached: 3

One of the most interesting examples of a blended finance fund in the blue space is the Sustainable Ocean Fund (SOF), launched by Althelia Ecosphere in partnership with the European Investment Bank (EIB) and the Global Environment Facility (GEF) in 2016.

The SOF is a USD53 million fund that provides financing and technical assistance to small and medium-sized enterprises (SMEs) operating in the sustainable blue environment and economy, such as seafood production, marine renewable energy, and ecotourism. The fund combines public and private capital, including a USD25 million commitment from the EIB and USD13 million from the GEF, on top of the private investment from impact investors and philanthropic foundations.

One of the most successful SOF’s investment case study is Algaia, a French biotech company that produces natural ingredients from seaweed for food, agriculture, and cosmetic industries. In 2018, the SOF provided a €2 million equity investment to Algaia, alongside private investors, to support the company's expansion and product development. This investment enabled Algaia to acquire a new production facility in Brittany (France) as well as to develop new product lines for food and cosmetic markets, whilst improving its sustainability and traceability standards.

Process of Issuance

Blended Finance - Key Structures

Source: Adaptation from Convergence, 2021

Key Practical Steps to structure a Blue Blended Finance Fund

Source: Author 2023